philadelphia property tax rate calculator

Set up Real Estate Tax installment plan. PHILADELPHIA City officials today unveiled a web-based calculator that will allow property owners to see how changes in assessments and the Mayors Fiscal Year 2019.

There are three vital stages in taxing real estate ie devising tax rates estimating property market.

. Submit an Offer in Compromise to resolve your delinquent business taxes. Ad Public Philadelphia Property Records Can Reveal Mortgages Taxes Liens and Much More. For example although Pennsylvania has a 150 average effective property tax rate the rates on a county level vary from as little as 091 to as high as 246.

Use the Property App to get information about a propertys ownership sales history value and physical characteristics. The citys current property tax rate is 13998 percent. Estimate your paycheck withholding with our free W-4 Withholding Calculator.

Your property tax rate could range as low as 091 like it is in Sullivan County or as high as 246 in Monroe. Then receipts are distributed to these taxing authorities according to a predetermined plan. It was launched soon after the Office of Property Assessment OPA released new assessments for over 580000 Philly properties.

This page is not an official county page. For comparison the median home value in Philadelphia County is. There is a general property tax rate of 13998 for the whole county comprised of 06317 allocated to the city and 07681 allocated to schools.

Check out our mortgage. The sixth-most populous county in Texas Collin County also has the 15th-highest property taxes. The City of Philadelphias tax rate schedule since 1952.

It is a free tax calculator provided by the Affinity Real Estate Team for estimation purposes only. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand. Complete and submit the FLR request form by September 30 2022.

Get help paying your utility bills. Buy sell or rent a property. Get home improvement help.

If you do not receive or misplace your FLR form contact 215 686-9200 to request a replacement form. Philadelphia property tax calculator. Philadelphia County collects on average 091 of a propertys.

The average effective property tax rate in Pennsylvania is 150 but that varies greatly depending on where you live. You can use this application to estimate your real estate tax under the Actual Value Initiative AVI. In Philadelphia County for example the.

Taxation of properties must. The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

1 be equal and uniform 2 be based on current market value 3 have one appraised value and 4 be deemed taxable unless specially exempted. Our Philadelphia County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average. The Actual Value Initiative or AVI is a program for re-evaluating all properties in the city.

For the 2022 tax year the rates are. Philadelphia property tax calculator. May 09 2022 To get an estimate of your annual property.

06317 City 07681 School. Ad View Your Homes Appraisal Value Suggested Listing Price - Fast and Free. Start filing your tax return now.

Request a circular-free property decal. Set up a Real Estate Tax payment plan for property you dont live in. View Property Appraisals Deeds Structural Details for Any Address in Philadelphia.

You can also generate address listings near a. Get help with deed or mortgage fraud. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200.

May 09 2022 To get an estimate of your annual property tax bill you can use a regular calculator to determine 13998 the citys.

Philadelphia Tax Abatement 2021 Homebuyer S Guide Prevu

City Releases Property Tax Calculator To Assist Homeowners Department Of Revenue City Of Philadelphia

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

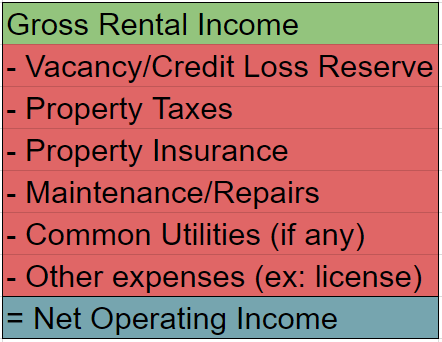

Cap Rate Explained For 2022 And Why It Matters With Rental Properties Coach Carson

.jpg)

Pa State Rep Property Taxes Time To Eliminate

Philadelphia County Pa Property Tax Search And Records Propertyshark

How Do State And Local Soda Taxes Work Tax Policy Center

2022 Best Philadelphia Area Suburbs To Buy A House Niche

New York Taxes Layers Of Liability Cbcny

How Nyc Property Taxes Are Calculated Streeteasy

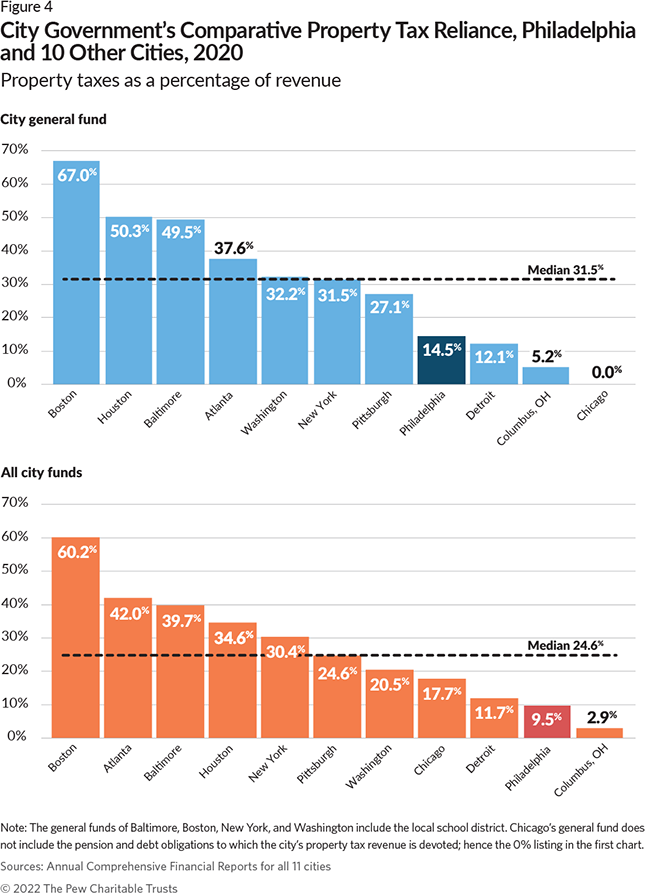

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

Philadelphia Tax Calculator The Affinity Team

Philly Released 2023 Property Assessments Here S How To Calculate Your Property Tax Venture Philly Group

Delaware Property Taxes By County 2022

Pennsylvania Property Tax Calculator Smartasset

Perry County Pa Property Tax Search And Records Propertyshark

Property Taxes By State How High Are Property Taxes In Your State